Table of Content

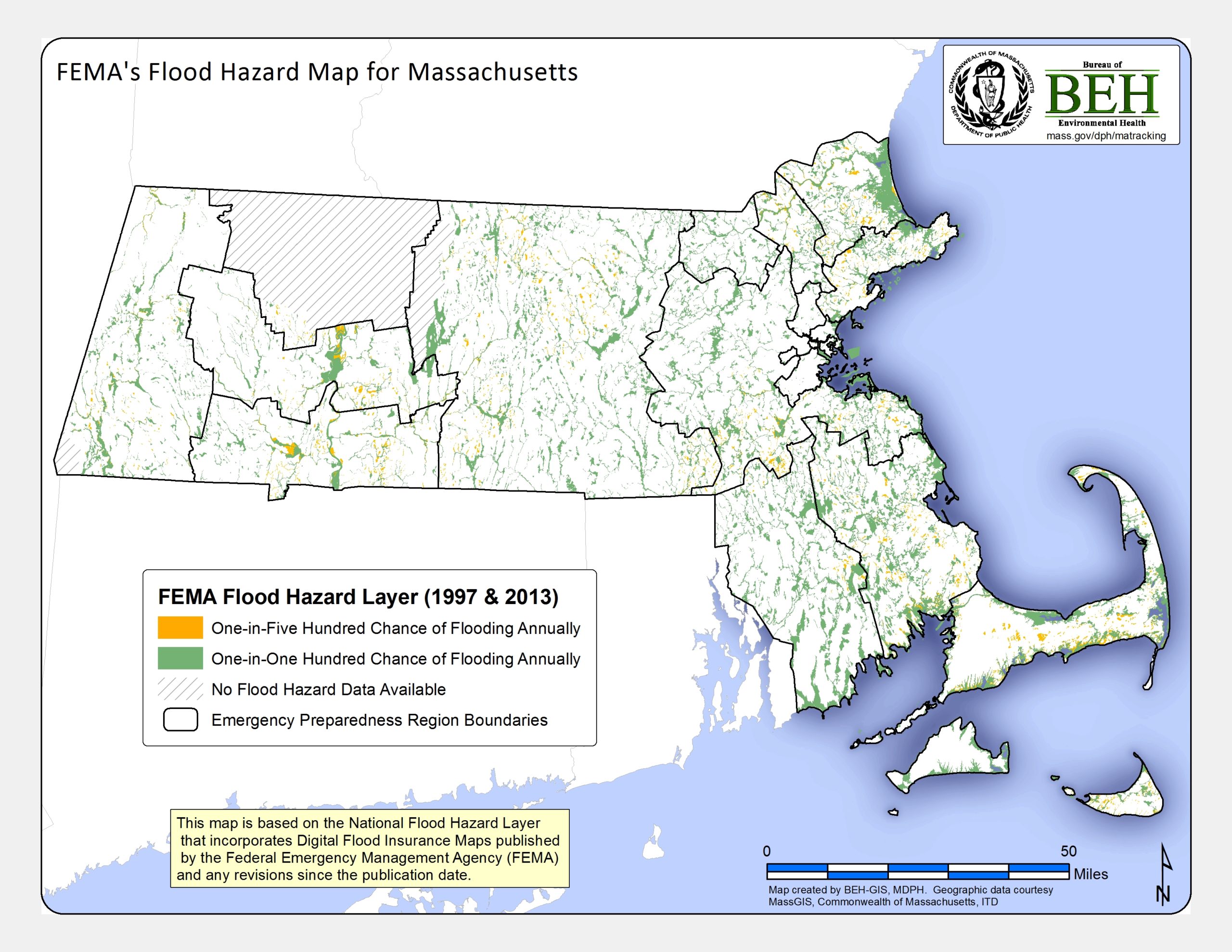

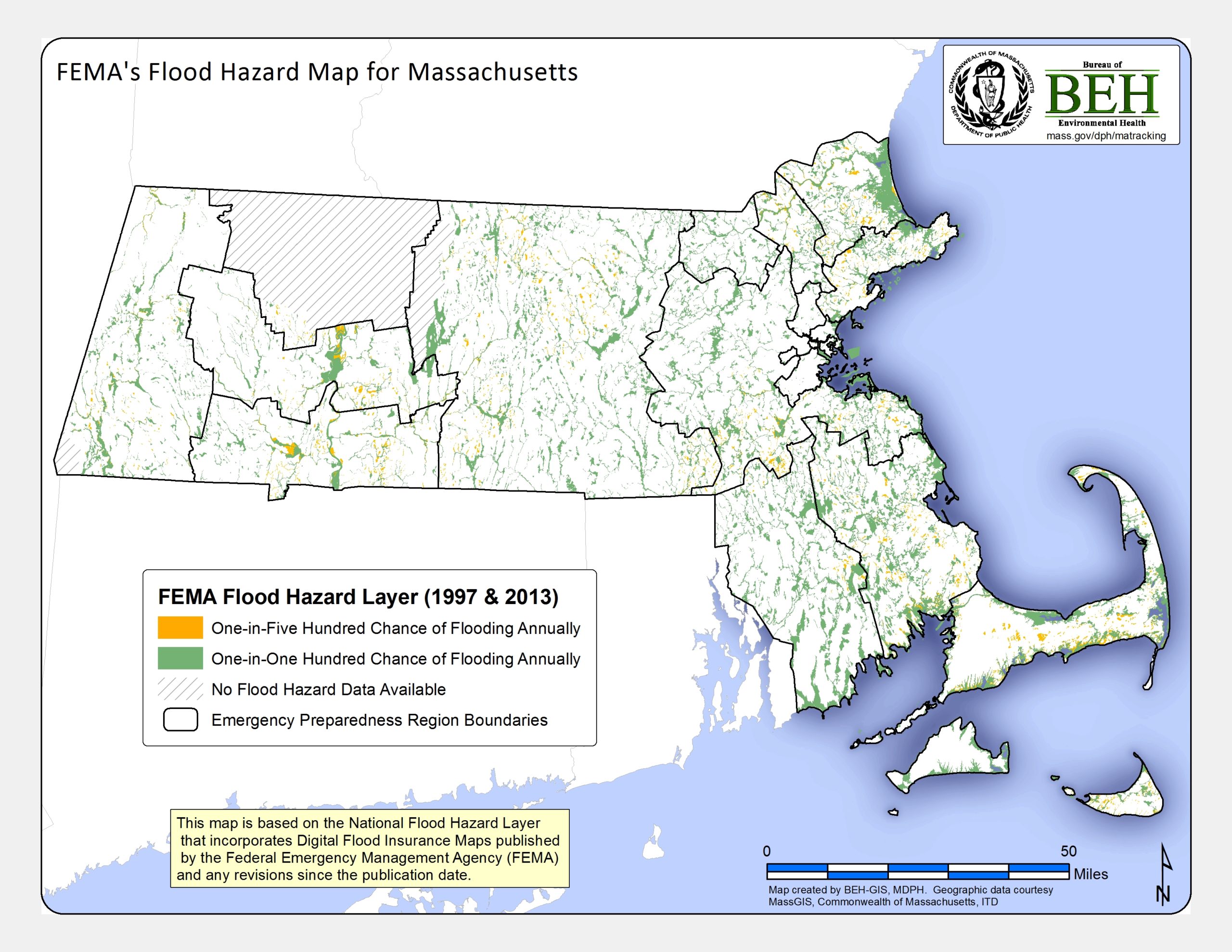

An unanchored fuel tank can be torn free by floodwater and the broken supply line can contaminate your basement. An outside fuel tank can be swept downstream and damage other property. If the policy already exists at this property and is being renewed with increased coverages. Homeowner B files a flood claim with his small deductible of $1,000 and gets a check for $199,000. If a property suffered flood damage 25 years ago, this doesn’t mean the property has 75 years until the next flood. 100-Year Floodplains (also called 100-year flood zones) are areas that experience about a 1% chance of flooding every year.

All coverages and services described in this page may be offered by one or more of the property and casualty insurance company subsidiaries of The Hartford Financial Services Group, Inc. The NFIP provides flood insurance to property owners, renters and businesses, and having this coverage helps them recover faster when floodwaters recede. The NFIP works with communities required to adopt and enforce floodplain management regulations that help mitigate flooding effects. No insurance policy retroactively covers flood damage you already have, so get your coverage before a hurricane or flood strikes. Protecting your home from natural disaster is a must no matter where you live—and we’re here to make the hunt for home insurance coverage easier than ever.

How Much Does Flood Insurance Cost?

You can get great rates and coverage when youbundle insurance policies through the AARP Auto and Home Insurance Program from The Hartford. After heavy rainfall, the excess water can cause nearby bodies of water like lakes, streams and rivers to overflow, causing flooding that results in property damage. Flooding can happen anywhere and at any time, so it’s important to always be prepared. But homeowner’s insurance won’t cover the significant damages caused by a river overflowing, tidal wave or regional flooding caused by a severe storm.

Depending on where you live, buying flood insurance or finding excessive flood insurance may even be mandatory. Federal law states that regulated or insured lenders must require flood insurance on homes located in high-risk flood zones. You’ll also need flood insurance if you live in an area prone to flooding and have received federal disaster assistance in the past. If this applies to you and you still lack flooding insurance coverage, you may be declared ineligible for future disaster aid. If you’re a Florida or Louisiana homeowner looking for new flood insurance, Kin has you covered.

Flood Insurance Flood Insurance Quotes Liberty Mutual

Up to 25% of all flood claims happen in low- to moderate-risk areas. That’s why even if you aren’t required to have homeowners flood insurance in your area, it’s still a smart investment. Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage.

Because homeowners insurance doesn’t cover flood damage, most Florida homeowners turn to the NFIP to protect their homes from storm surges. Most property insurance providers don’t offer flood insurance policies, so they aren’t usually “bundled” like auto / home households. However, nearly every property insurer will offer a meaningful discount on a homeowner’s policy if there is an additional flood policy. No state or federal government agency requires property owners to maintain flood insurance at a property if there’s no mortgage. Still, many homeowners sleep better at night knowing they’ve mitigated the risks of flood damage.

What does flood insurance cost?

This separate catastrophe insurance will provide coverage specifically for water damage that occurs from flood events. The Hartford's Flood Insurance Plan features specialists ready to answer your questions and provide you with a fast, personalized quote. If you choose to purchase flood insurance coverage through this program, you can rely on our highly rated customer service team to support your flood insurance policy needs. Should you need to report a flood claim, you can reach us anytime through our 24-hour Claims Hotline. You don’t have to live in a high-risk flood zone to be in danger of flooding. The National Flood Insurance Program reports that more than 20% of flood insurance claims are located outside of high-risk flood zones.

That depends on where you live and what your mortgage situation is like. Many mortgage lenders require flood insurance if your home is near a body of water, too. There’s no waiting period for our flood coverage, and it’s effective immediately. By comparison, the NFIP has a 30-day waiting period before coverage takes effect.

For all of Florida, the average flood insurance premium is $856, but low-risk counties will pay much, much less. That’s because the cost of flood insurance varies depending on your home’s flood zone. Flood insurance is a federal government insurance policy, and we offer policies underwritten and processed by several major insurance companies. Condo unit owners and tenants can also purchase flood insurance. Condo owners may alread have flood insurance on their unit with their condo association. If not, they can purchase flood insurance for their interior as well as their contents.

That’s why flood insurance for homeowners is critical for protecting you against loss and damage to your home and belongings, no matter where you live. Homeowners insurance is built upon fire coverage, plus coverage for perils such as wind, hail, lightning, and civil unrest . Coverage for water damage is not typically included in the standard home insurance policy, but is still important protection to have. And lastly, if you have a federally backed mortgage and you live in flood zone A or V, you are required to purchase flood insurance.

Flood insurance is a type of property insurance that covers a dwelling for losses directly caused by flooding. Put simply, it’s an excess of water on land that is normally dry. Flooding is caused by heavy or prolonged rain, coastal storm surges, melting snow, blocked storm drainage systems, and even levee dam failure. Flooding can cause significant destruction to a home—and if you don’t have flood insurance, you won’t be covered against the damages to your home and belongings. It is a separate policy that goes beyond the usual coverages provided by a homeowners policy, landlord protector, or commercial insurance policy. Flood insurance serves to protect the structure and personal/business property from the specific perils of coastal flooding, flash flooding, groundwater flooding and so on.

The Home Program is underwritten by Hartford Insurance Company of the Southeast. Your furnace, water heater, washer and dryer should all be 12 inches from your basement floor. To raise them to this level, place them on top of masonry blocks, concrete, or pressure-treated lumber. Downspouts should carry water several feet away from your property to a well-drained area. Insurance solutionsto protect businesses from the unexpected.

Your AOP deductible applies for both home and flood insurance claims. “According to feedback from member insurers, the take-up rate in most provinces has grown steadily every year since the inception of the product,” he says. Overland flood covers damage from water running over the surface of the ground and through doors and basement windows into homes.

Instead, there is a 1 in 100 chance this property will experience a flood every year. The property was inherited or “gifted” by a family member. Personal property Clothing, furniture, and electronic equipment that isn’t stored in the basement. Even one inch of standing water can cause $25,000 in damages to your home.

No comments:

Post a Comment